An article by Sebastian Hartmann & Stephan Kaufmann, originally published in LegalBusinessWorld No.3, 2020

The cost pressure is on for professional services. Shifting client demands, declining prices, new technologies, and an emerging set of fierce competitors are taking a toll on law, consulting, tax, and accounting firms. Especially in times of crisis, cash is king. Once the topline deteriorates, outlasting the competition requires superior cost management. COVID19 is surfacing which firms have successfully adjusted their business and operating models and will be able to cope with the harsher climate of a global recession – and the accelerated digital transformation of professional services. But what exactly are the cost levers when the game is no longer about utilization and hourly rates?

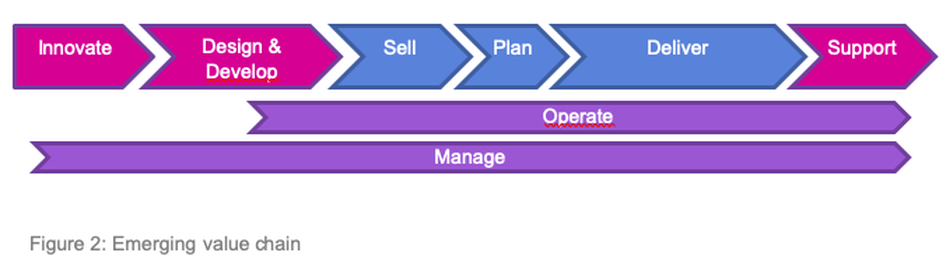

Earlier this year, we explained the emerging next-generation value chain for professional services firms in Legal Business World (see here). We described the up- and downstream extension of the traditional value chain – adding elements such as innovation, design, development, service/product management, and even after-sales support. The changing value chain is reflected in the multitude of new roles in professional services firms (e.g., in law firms, we now find legal designers, solution architects, engineers, data scientists, operations and project managers, legal ninjas…, etc.). Underneath, we also see a more front-office related operating layer emerging – especially around the technology embedded in client-facing delivery work. The management layer, in the meanwhile, needs to rise to unprecedented importance and professionalism for handling the emerging complexity.

Figure 1: Emerging value chain

So, the overall mechanics of professional services are changing drastically – and that includes the financial model and the available cost levers, which need to be mastered by managing partners, CEOs, COOs, and other leaders across the firm. In the following sections, we will work through some of the essential cost levers – one by one along the next generation value chain:

Innovation – Cost Levers:

- Client co-creation: Innovation should always start with clients – their needs, challenges, or issues to be solved. Getting clients to pay for the creation of something new is, of course, common practice in professional services. Explicitly co-creating solutions, which may also be sold to other clients, however, is a different game – a game for which legal (e.g., IP), financial and operational implications need to be diligently managed. When investment budgets are scarce, co-creation is the best method to avoid developing a market flop and thereby sinking vital cash. It is by far the most cost-effective way to design, develop, and launch a new solution, service, or product.

- Ecosystem innovation: Limiting the search for innovation to your organization alone is like walking around blindfolded and only using one ear to listen. Understanding and leveraging a firm’s ecosystem as a potential sensory advantage can significantly lower the R&D spend and broaden the spectrum of innovation options (by incorporating clients, suppliers, and alliances). This lever, however, is not just about “increasing the firm’s surface” for ideation, but probably even more about the efficient design, development, and go-to-market of innovative solutions through ecosystem partners.

Sales – Cost Levers:

- Pricing model: The extended value chain and client ask for incentive alignment (= outcome-based compensation instead of billable hours) requires firms to re-think their pricing. The emerging answers acknowledge value (throughputs or outputs) as price drivers instead of cost (inputs). A value-based pricing model unlocks the opportunity to de-couple revenue and costs for professional services firms. Technology costs and other elements can be incorporated much easier, and economies of scale can be leveraged at a much higher level (see also the cost levers in the “Solution & Delivery” section).

- Growth hacking: Growth hacking describes an organization aggressively focusing on ramping up solution, service, or product sales often through relentless digital sales. It thereby often seeks to utilize and expand existing networks of the firm’s individuals (bottom-up). The approaches focus on low-cost, targeted, and direct access to desired clients – often through social media and digital content. Growth hacking banks on speed and determining a product’s viability in the market. Fast success (or failure) is the consequence and makes it so much more cost-efficient than many traditional sales approaches.

- Sales partnerships: Leveraging go-to-market alliance partners can be very cost-effective for many reasons. First of all, an alliance partner salesforce can be leveraged for both existing clients (broader penetration) and new client segments. Another reason is the cost-effective differentiation of the value proposition design itself, which is enhanced through the combination of complementary elements, e.g., expertise and technology. Needless to say, a trusted alliance partner vouching for your firm is also worth more than narcissistic self-promotion. Played well, both alliance parties benefit equally, as this logic applies vice-versa.

Solutions & Delivery – Cost Levers:

- Standardization: Professional services have evolved from highly bespoke advice towards delivering much more client-centric solutions. This evolution was predicted by Richard and Daniel Susskind several years ago. The basic stepping stone in their model is the decomposition of solutions, services, products into methods, insights, tools, and delivery processes. It unlocks the most potent levers outlined in our article: Standardization, digitalization, and automation. Most firms are still surprised how easy it can be to take the first steps by merely leveraging already existing data, templates, and best practices. The key, however, is the repeated and very systematical use of declared standards across all applicable client engagements – and the subsequent closing and use of feedback loops for rapid, continuous improvement. So, here’s a practical example: Engaged by a consulting firm a few years ago, we have been able to standardize their five top-selling solutions (accounting for >70% of revenue) within six weeks – and thereby improved contribution margins by 6-11% within a year. This has also improved the adherence to project plans and client satisfaction scores at the same time.

- Digitalization & Automation: Developing and deploying standards in professional services is often based on Microsoft Office formats, such as Word, Excel, or PowerPoint. Deploying such standards to client engagements through service-specific pre-configurations of collaboration sites (e.g., SharePoint or Teams) is not rocket science anymore. But it is impacting the ways of working for many professionals and may require extensive change management and user enablement efforts. As firms progress on this journey, the emergence of low-code and no-code platforms is taking bespoke applications, smart workflows, and analytical capabilities to a new level – at scale. To put this very simple: Do not teach coding to lawyers! It is not necessary. Focus on providing the right toolset and workplace environment instead. These environments also make the knowledge work of professionals accessible to the power of analytics and systematic workplace optimization. There are several explanatory videos about this out there. Most of them based on technology, which your firm is probably using already. Automatic time capturing is another critical element here – especially for firms, which are still running on time and material models. Automatically capturing and allocating the time of professionals to client projects and other task buckets not only increases immediate financial realization opportunities but also improves visibility into the actual costs of delivery, sales, and other activities.

- Virtual engagement design: The current pandemic and recession are accelerating remote and virtual collaboration models across all industries. Facetime and onsite presence are deteriorating even faster now and will probably never come back to pre-COVID19 levels. But aside from the associated impact on pricing models and solutions, these new modes of collaboration allow for a completely new structure and setup of client engagements. For example, leveraging a single expert in multiple client projects around the globe is getting much easier when no one is expecting this expert to appear physically in a conference room. The usage of more cost-effective delivery resources as another example is also so much easier when the client is focused only on the deliverable. If you think that switching to video conferencing and some collaboration tool is all it takes to deliver virtual client engagements, you are leaving a lot of money on the table – or may even have to give up your seat at the table soon.

- Shared delivery & outsourcing: Hand in hand with the decomposition of knowledge work, many larger firms have started to invest in shared delivery centers in the last decades. Repetitive tasks across client engagements have been pooled into shared delivery centers, are being outsourced or automated altogether. The outsourcing provider landscape has matured alongside this development – and is now able to cater to ever-smaller volumes of work or higher levels of complexity. Many providers also strive for deeper and smoother integration with their clients through digital interfaces and connected workflows.

- Flexible contingent workforce: Hand in hand with the previous aspect, a contingent workforce is about building more flexible “breathing” capacity into your delivery. Some firms have begun to make this a policy under normal circumstances, e.g., by resorting to 10-30% of freelancers or other subcontractors at all times (while monitoring for dependency and lock-in). This setup gives firms the flexibility to quickly ramp delivery capacity up or down depending on the situation. It is not just critical in the current, harsh climate, but also key to seizing the eventual pickup in demand. Tapping into this market of freelancer talent is not difficult any more given the greatly improved visibility through marketplaces (like Upwork) or social networks, like LinkedIn.

- Sourcing: The latter also goes hand in hand with the rising importance of the Procurement function – and the absolutely and relatively growing external spend of many professional services firms. Procurement needs to step up its game – as it has in many other industries before. Legal, consulting, and accounting firms must realize the immense potential of building a responsive, flexible, and cost-effective supply chain, which underpins the client delivery work. Specialist sub-contractors, outsourcing providers, third-party research, analytics, development or design services, and technology providers are the typical focus categories now. These categories directly contribute to client delivery work and can improve both speed and quality for clients next to the cost benefits for the provider. In these cases, negotiating a new contract every two years or so and working through purchase requests from professionals is not enough. The entire strategic category management playbook needs to be applied here: Engaging with business owners about their demands, surfacing market options and trends, modeling financial implications of business requirements, deriving targets and benchmarks, managing supplier portfolios, or establishing accountability with demand owners for their spend. So, it is about managing costs from both the supply and the demand side. The effect of savings or cost avoidance on external spending may easily outweigh an increase in the revenue side regarding the impact on profitability. The savings may represent disposable partner income – or additional budget for investments.

- Client segmentation: The fact that client journeys and requirements greatly vary is often overlooked. While some engagement types or services require 24/7 attention, others allow for a more punctuated deployment of resources. Firms can use this to their advantage by explicitly designing distinct quality and experience levels throughout their solution, service, and product portfolio. Instead of a universal quality level, differentiated journeys and delivery approaches (depending on the client or service) allow the firm to allocate resources more optimally. Client experiences do not need to suffer – instead, they are more adequately shaped to suit the visibility of the work, the deliverables, and, of course, the client’s quality requirements.

- Technology management: Next to personnel expenses, technology is on its way to becoming the second-largest P&L constituent. In turn, managing technology costs is no longer a back-office activity but gravitates towards the center of next-generation financial management of professional services. Typically, one can differentiate cost measures based on the time horizon of their effects. Immediate effects stem from measures like headcount reduction, postponing projects, and changes in IT support outsourcing and are considered cost-cutting. Cost optimization, on the other hand, concerns process standardization, data center consolidation, and the migration of existing services to cloud-enabled XaaS offerings. These measures carry yields, however, probably more on a mid- to long-term horizon – and in terms of up- or down-scaling flexibility. Unfortunately, we find many firms still lacking mature technology management practices. Having come from a “keep the lights blinking” mandate, most CIOs are challenged by the growing front-office demands and attention. CIOs must now provide a clear definition of technology services and cost in business language – and as a constituting element to client delivery work. Approaches like technology business management (TBM) can help to overcome this hurdle. They shape the technology organization to work in-sync with the business and integrate technology in business models, pricing, cost management, and solution (service, product) design.

Support, After Sales – Cost Levers:

- Service level differentiation: Many firms proudly consider quality one of their biggest differentiators over competing firms. However, few firms succeed in achieving optimal quality. Optimal quality is not synonymous with the highest quality – contrary to many professionals’ mindsets. That is particularly important in after-sales support, which is growing alongside subscription, XaaS, and classic managed services offerings. While clients traditionally can expect almost instant responses during traditional onsite projects, in a more long-term support model, response times need to be tied to service levels. This differentiation enables better cost management and best-fit service quality for each client segment.

- Cross-/up-selling: Support and after-sales are not only important to sustain deep and meaningful client relationships (= keeping them happy, active, and paying) but furthermore to cut the overall cost of sales. After-sales is one of the most overlooked cross- and up-selling opportunities in many firms. Clients who are willing to bridge from a one-time engagement into a more continuous, recurring liaison with the firm are also more likely to follow suit with an additional or better solution, service, and product purchase (e.g., higher service levels, see above).

Many of these cost levers are not short-term oriented, but about the longer-term competitiveness of professional services firms. As such, we consider these levers as critical pillars of success for the emerging next-generation value chain management in legal, consulting, tax, or accounting services. With the accelerated pace of change, which we can see in the market today, the focus of leaders and managers must shift from quick fixes to the constant adaptation to a changing and more dynamic environment.

Unlocking these cost levers, however, requires institutionalized ownership. Firm leaders need to introduce roles and responsibilities around each lever and assign dedicated resources with clear targets. It is important to assess how these might conflict with established roles and responsibilities. To help overcome potential contradictions, firms require a more holistic management reporting capable of tracking profitability in different business dimensions and granularities. Reporting performance for each practice group, office, and down to project (engagement, matter) and solution (service, product) levels is vital to effectively managing cost lever ownership and ensuring compatibility of roles within one firm. Firms with this prioritization of management excellence thrive even in uncertain conditions and outperform their competition. These firms have established resilience by structurally addressing profitability and systematically reducing dependencies on the fading input-based business models.

Let us know your thoughts and experiences around the next generation value chain management fo legal, consulting, tax, accounting and other professional services!