An article by Stephan Kaufmann and Sebastian Hartmann, August 2019

Key Facts:

- To unlock scalable growth, professional services firms must shift management attention from dividend payouts to firm value

- Funding sustainable transformation projects requires conscious long-term value orientation

- Employee retention enhances with participation in firm value not one-off bonuses

Over decades, consultants, lawyers and accountants have helped clients increase their firm value. Quite astonishing though that they seemed to care quite little about their own professional services firm’s value – unless they were to sell it, of course. Hence, a closer look at the economics of professional services firms (short: PSFs), both traditional and emerging, helps to understand the financial root causes of the inertia we can observe in firms in the face of digitization, innovative new competition, changing client and workforce demands and alternative business models.

Traditional financial management of PSFs is approaching its expiry date.

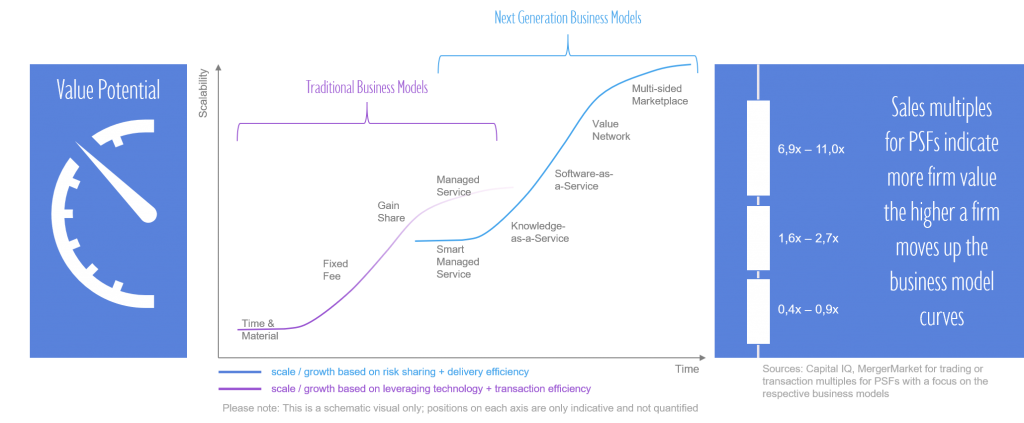

The inherited financial characteristics of PSFs operating in classic partnership models – as outlaid by Mark Scott – provide us with some key explanations why long-term orientation (beyond a single fiscal year), larger investments and partner age gaps pose such a fundamental challenge: Under the assumption that a PSF’s only significant assets are its specially-skilled workforce and the goodwill of client relationship, its balance sheet is outrageously short (relative to its revenue). Firm revenue is mostly constrained by the availability of a capable workforce and the firm’s ability to realize its fee capacity which translates in a growth of client billable hours. However, firms operating on the ‘time & material’ business model incur an almost linear relationship between revenue and cost since almost all cost is personnel and therefore variable. Achieving economies of scale is therefore difficult beyond some back-office synergies. Nonetheless, PSFs have proven to be outstandingly effective in converting revenue into distributable cash (as dividend payouts) to shareholders. Besides personnel cost, the other big cost constituents root from real estate, capital leases (for IT-equipment) and overhead (in management, middle and back office). The remainder after deduction of any net financial charges (e.g. investment in working capital) represents the distributable cash to shareholders. The most common ownership model, the partnership model, banks on the firm’s ability to convert revenue into dividend payouts. Consequently, partners pay little attention to capital gain yields but high attention to dividend gain yields – an approach that carried fruits for decades and just recently entered decay. This decay is driven by the tectonic paradigm shift Professional Services undergo (revisit the PSF paradigm shift here). Just logically the established partnership model (and underlying financial incentive mechanisms) is hitting its glass ceiling hard as clients pay closer attention to align a supplying PSF’s interest to their own.

The traditional PSFs underlying financial incentive scheme contradicts long-term orientation.

Eat what you kill: PSF are inherently Darwinist. To climb the ladder, one had to survive up-or-out and once on the top, the egocentrically educated partner fights for revenue – their personal revenue. Even though clients have moved way past silo-like thinking and demand solutions, hunting in packs is foreign to partners in traditional PSFs. Unconsciously, they cost the firm a fortune in revenue by foregoing collective sales for their personal benefit.

Age-Pyramid: Climbing the ladder takes time. The hierarchical structure of many PSF strongly corresponds to age. Despite some rising stars most firms’ senior management is indeed senior. This is not necessarily bad but can cause inertia when it comes to innovation and transformation. Especially in an incentive model that is based on short-term performance. Why would a partner at the top (and often at the end of their career) fund projects with break-even in multiple years? Even investments in scalability of a PSF’s offering, for example through the digitalization of services, are often denied by a few but powerful shareholders. Nonetheless, these investments are a necessary for PSF and its partnership model to survive long term. If performing employees find a firm stripped of its future readiness there will be little willingness even to become partner.

But there is hope. Looking at common PSF value drivers reveals transformational opportunities. Firstly, PSF thrive with recurring business. Recurring business is not only achieved through a strong client relationship but also through entering new business models like subscription or XaaS models. Secondly, valuation increases with a consequent decoupling of growth from human capital constraints. As outlaid above, PSF rarely achieve economies of scale if they remain in the ‘time & material’ space. Achieving scalability, e.g. with the deployment of IP, software, etc., frees PSF from their dependence on human capital and helps them to grow both their top and bottom line. Thirdly, orchestrating different business models under one brand gradually increases a PSF’s valuation. The idea of recurring business, scalability and different business models is at the core of valuation.

Putting firm value at the heart of leadership opens new possibilities for PSFs.

We therefore argue that a serious reconfiguration of the partnership model to incentivize long-term value orientation, lays the basis for future success. Here is why:

1) Better fact-based strategic and investment decisions

Value-oriented PSFs focus on strongly steering their individual solution portfolio in search for unexploited existing and new potential – both in terms of performance and risk. This leads not only to better strategic thinking but also an enhanced resource management for both human and financial capital.

2) New talent acquisition and retention options

Talent retention is increased as talent seeks to participate in growth versus short-term incentives. Have you ever wondered why talent left to work at startups? Pretty sure, it was not due to a one-off bonus but the change to seek entrepreneurial responsibility for long-term growth. Building an environment where employees are giving the freedom to execute on business plans that do materialize beyond a one-year period is vital to retain talent.

3) More power to innovate, transform and evolve

Long-term orientation facilitates large scale transformations necessary to handle the tectonic paradigm shift described above. The same applies to innovation strength. Managing for firm value incentivizes innovations and respective business models. Shifting towards firm value and away from one-off bonuses helps to bridge the partner-age-gap and prevent junior partners from losing their innovative edge caused by malfunctioning incentives. Furthermore, this approach is granting access to new capital. Innovation can be funded through internal crowd funding, for example, where shareholders participate along an innovation’s life cycle. This method even encourages staff to participate in growing the firm’s value. Another funding approach can involve external capital, like venture capital.

The entire professional services industry is called to act.

As emerging PSFs are pioneering new, value-based management approaches and successively gain market share, traditional PSFs are called to reconsider their inherent incentive models. The underlying paradigm shift can help the entire professional services industry to shake off some of its most daunting flaws and reinvent itself, once again, to be stronger and even more ready for the future than ever before.

________________________________________________________________

Follow me on LinkedIn or Twitter for regular updates and information about Professional Service Firm management and leadership: #NextGenPSF

Get in touch and share your thoughts – looking forward to hearing your comments!