An article by Sebastian Hartmann and Stephan Kaufmann, October 2019

The signs for a major economic downturn are clearly starting to show across several industries – and in professional services. Since external contractors are an easy cost riddance for most clients, this should not come as a surprise to professional services firms (PSFs). Of course, the majority of PSFs is quick to adapt their story-telling accordingly (talking cost optimization, efficiency etc.). But there is a more interesting hypothesis we would like to point out: This downturn may increase the speed of the ongoing paradigm shift in professional services, heat up the already increased competition and further dampen the market attractiveness of many fields (e.g. like the commoditization in many tax services). Structural short-falls that have so far been covered by a thriving economy are now being revealed. This recession may hence become the catalyst of the long foreseen true “disruption” to lawyers, consultants, accountants and tax advisors. Those PSFs trying to simply weather this out (like they always have) may suffer strategically and significantly.

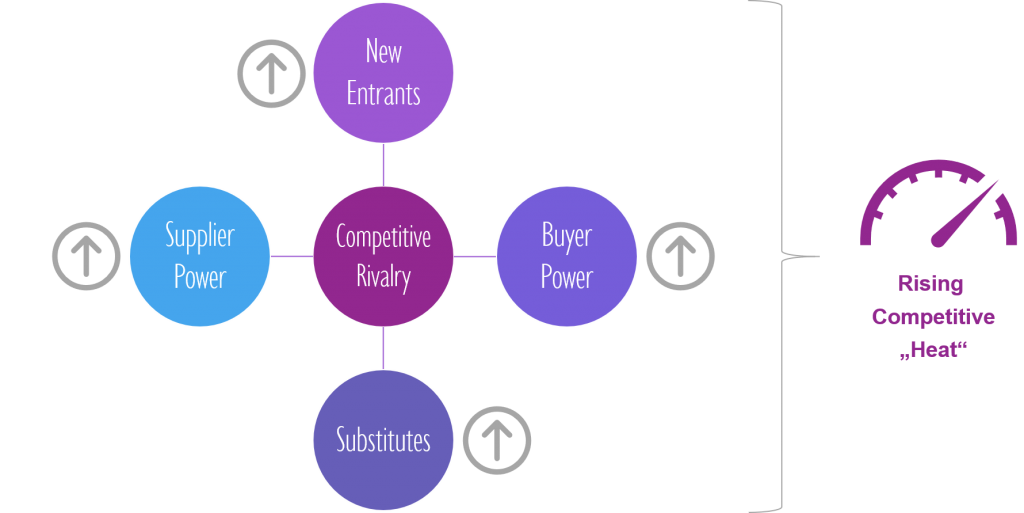

Let’s look at some key changes since the last global recession in 2008 and how they affect the professional services market’s attractiveness:

Clients & Solutions

For the legal profession Marc A. Cohen nicely summarizes this as “corporate consumers call the shots now. They have effectively marginalized archaic, self-serving, and protectionist lawyer self-regulation. More importantly, they – not law firms now determine value, what is and is not a ‘legal’ matter, when lawyers are required, from what delivery model they are optimally deployed, and at what price.” Albeit his focus is mostly on lawyers, the painted picture extends across tax, accounting and advisory services. So, with clients being much more emancipated and articulate about their needs, the rise of the term “solutions” across the professional services industry gives testimony to this seismic shift in thinking: It expresses the demand for more measureable, tangible and often more sustainable solutions to client issues. Growth and profitability are therefore not (just) a question of billable hours, utilization or hourly rates any more. The recipes have changed, and industries converge – even if some firms and leaders are still shaking their heads in disbelief. The artisan guilds across the professions are fading and professionals are finally becoming much more “professional” about their own business, value propositions, delivery and operations.

New Entrants & Substitutes

The past ten years have seen an ever-increasing emergence of new technology-driven solutions – with significantly changing business models and very different ecosystems around PSFs. The classic trajectory from the lower-end outlined by Prof. Christensen is a fact. High prices, uncomfortable uncertainty, lots of effort to source professional services and the digital mindset of the next generation of procurement professionals are providing plenty of motivation for corporate clients to “try something new”. The “alternative provider” to the classic lawyer firm, consultant or tax advisor is now a reality – not science fiction or gloomy forecasts. The influx of significant capital underlines this: +718% in 2018 and already beyond 2018‘s billion dollar mark within the first three quarters of 2019 for legal tech alone. With technology providers and digital businesses, the competition is much broader, looks quite different at times and is more than ready to fight for significant market share. Also, some advisory work is now delivered internally. Most corporates have their own project managers, inhouse consultants and even increasingly well-staffed legal departments. PSF alumni happily find their ways into the clients’ ranks. Ultimately, both new entrants and substitutes intensify the competition in many fields – which can be too though to conquer for traditional PSFs.

Existing Competition

The competition between existing players is tougher than ever – and the search for “greener grass on the other side of the fence” has in many cases blurred the competitive profile. Audit firms have grown their advisory business, law firms have discovered the one-stop-shop concept, and strategy consultants have evolved towards implementation consulting. Competition is tense – and we see hourly rates deteriorate across several areas. That the pie has grown on the back of overall economic heights has only tricked many firms into believing that their strategy worked out (often without serious investments). But losing a ‘true competitive edge’ can come costly, as the former managing director of an American law firm admitted: “Expanding into new business first increased our total revenues but by losing our clear edge, we could not sustain our above-average charge-out rates, attractive remuneration packages and therefore struggled to hire the most suitable talent. It truly is a vicious circle.”

Suppliers & Resources

The “magic aura” of many professional services firms has worn off for today’s graduates. Giving up time for family and friends or sacrificing personal health is not a sign of success any more. And while many (even fairly young) leaders still moan the decline of “the good ol’ days”, we should all be grateful: Sustainability, the most important topic of our time and for generations to come, also starts with ourselves, our energy, our health and beloved ones as a resource. Looking for statistics? The rise of the gig economy should act as a clearly visible signpost for our industry. Furthermore, today’s emerging workforce claims not only ownership of their results but also their fair share of value-add. And let’s be honest: The time we spend to create and deliver a solution to our clients is not the suitable proxy for the value we add – maybe even the opposite (“working smarter, not harder”, right?!). But meanwhile and on a much more positive note, PSFs are realizing their urgent need for innovation at the core of their business – and they may finally come to grips with diversity as a vital source for their future readiness and competitive advantage.

In short: We believe the market attractiveness has changed significantly for professional services firms. With a cooling off economy and decelerated growth in established professional services, the unpleasant truth surfaces. Many professional services firms will have to deal with the inertia or lack of commitment to their transformation efforts these past years (also see our article on the “Silent Killer of Future Readiness in Professional Service Firms”). But the symptoms of the underlying paradigm shift are not going to disappear – and the coming economic downturn is likely to even become a catalyst for the evolution… or even disruption.

So, what’s the outlook for professional services? And what is the worst that can happen? Yes, some firms may go down the recession’s drain. However, there is also an unprecedented need for professional services across the globe – most likely with a different profile though. Firms capable of adjusting to this change, and managing to reinvent themselves, will thrive – probably to an unprecedented extend. The dynamics of digital business models will make sure of this. And these next generations PSFs are likely to soak up all the talent they can get. The result will be a new competitive landscape for professional services. Maybe a better one for clients, providers and employees alike.

So, what can your firm do right now? Well, let’s talk about it, follow us on LinkedIn or Twitter for regular insights for professional services (#NextGenPSF) and take an assessment of your firm’s readiness for this new game here >>

Looking forward to hearing your thoughts!

This article was originally published on LinkedIn.