An article by Felix Fischer, Stephan Kaufmann and Sebastian Hartmann, October 2019 (updated version)

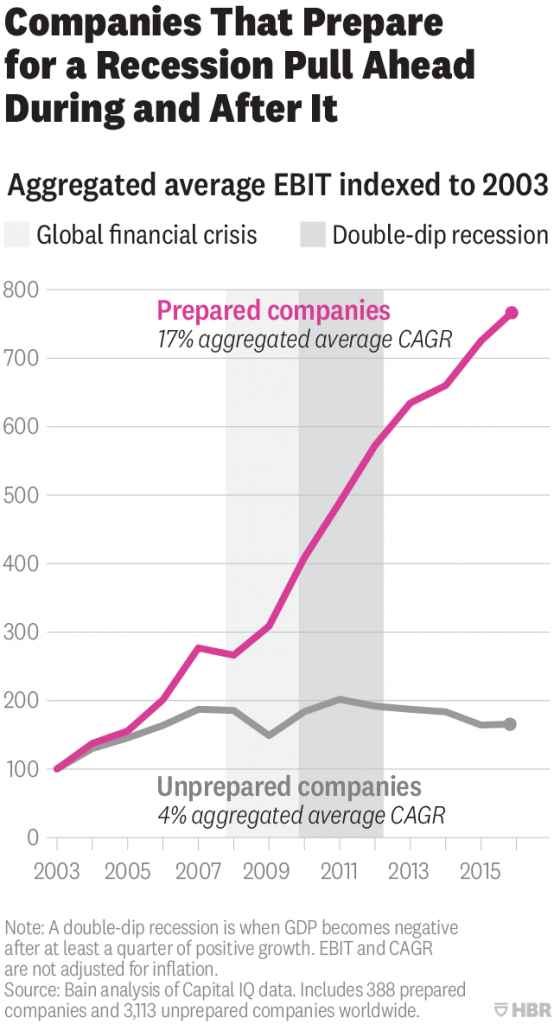

Since the economic fallout of 2008/2009 Professional Service Firms have flourished under the prosperous economic environment, the „digital transformation“ demand wave and deep client pockets. However, with ever increasing head winds due to the imminent threat of an economic downturn, fostered by high uncertainty events like the effects of the technology revolution for the services industry or the global trade war, the rules of the game are likely to change …

How well Professional Services Firms (in the following PSFs) will be able to continue to “score”, will depend on the degree of resilience within their revenue structure and their ability to grow and occupy new market space amidst a recession. In order to identify the parts of the business which need to be scaled down, “maintained” or where the firm can even realize new growth potential, PSFs must look at their solution portfolio from various angles.

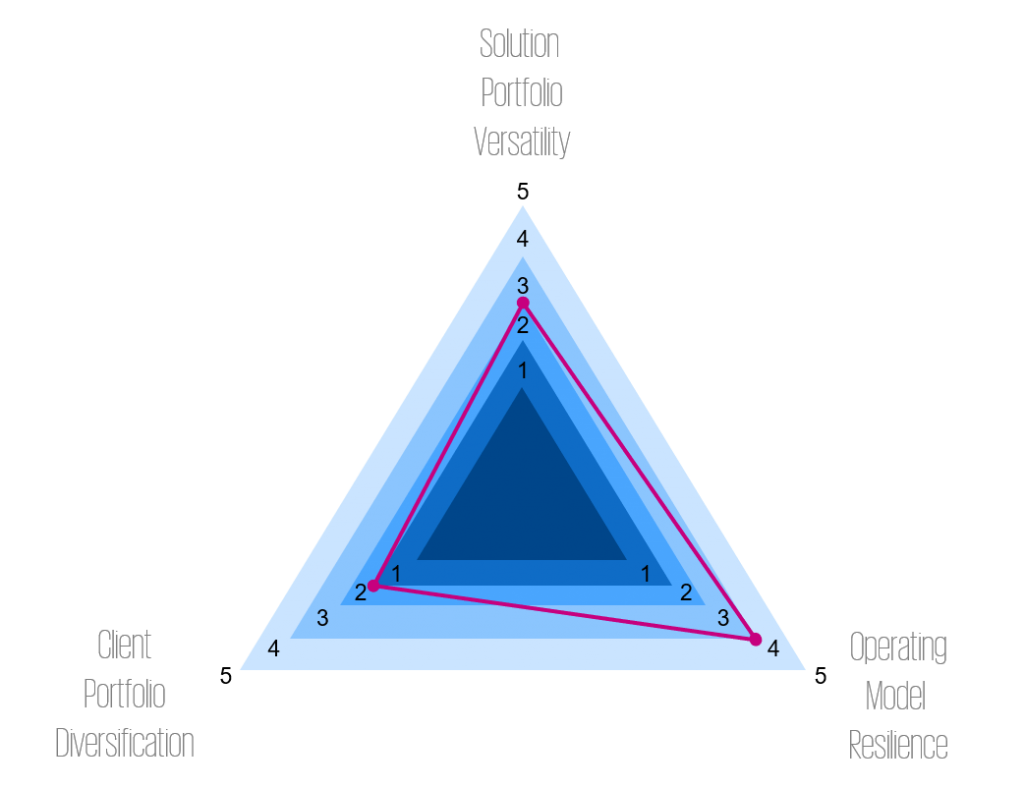

The following paragraphs highlight three possible angles how PSFs can set their game plan in anticipation of a recession – namely client portfolio diversification, solution portfolio versatility and business model resilience.

#1 Recession Exposure through the Client Portfolio

Firstly, by nature, some industries react more volatile to economic fluctuations than others. In the CAPM model, a commonly used model to price assets (e.g. securities or stocks) while factoring in the asset’s risk described by the beta factor. Beta is the degree to which a given stock reacts to the market. If beta is equal to 1 the stock practically moves with the market. If beta is above 1 the stock responds stronger to market up- or downward movements. If the beta factor of a given stock is negative, the value moves opposite the market. Hence, if the market goes up the value of the stock goes down and vice versa. This concept can be generalized for industries and sectors. In consequence, sectors which suffer stronger from economic downturns, will need to cut costs more drastically compared to less volatile sectors in anticipation or during a recession. Therefore, in the face of a rapidly approaching economic winter, PSFs are well advised to evaluate their client structure in terms of their market volatility. Wherever possible PSFs may want to focus more on low volatility client sectors like the medical, pharmaceutical or public sector, in the near future. Furthermore, the geographic diversification of the client portfolio should also be taken into consideration as regions differ in their exposure to global crises and growth prospects, as well. Of course, most firms cannot simply change the structure of their clients. But they should have a clear idea about their recession exposure based on their client base and how it maps onto their solution portfolio.

#2 The Solution Portfolio Profile in an Economic Downturn Context

Secondly, on the way to build better recession resistance, PSFs must focus on plannable, recurring and steady revenue. Because clients will start to re-evaluate all external providers, PSFs should adopt a client-centric management view, breaking traditional department silos, allowing to determine the real value of each solution delivered to the client. During a recession, all non-mission critical services delivered by third parties, will be under pressure and are the most likely targets for budget cuts. Thereby seeking to invest in all solutions which clients consider essential to their success, PSFs can avoid running into project or budget drainage. Aside from nurturing resilient engagements, resources focused on low performing solutions should be shifted towards more prosperous solutions. If necessary, divesture from non-performing solutions must also be considered. As an example, in light of a dim economic outlook, expenditures on “classic” strategy or transformation projects (e.g. expansion strategies, M&A projects or large-scale IT implementations) are likely to come down, whereas projects with a focus on process optimization, outsourcing or cost cutting activities will experience an increasing demand. Again, the opportunities for short term shifts may be limited within a PSFs portfolio of solutions and capabilities. But the combinations (e.g. cost cutting solutions as door openers) and “packages” or “bundles” can often be adjusted very quickly. These are the kind of moves where firms with a smart portfolio management, proactive solution (portfolio) management and data driven sales intelligence can outpace their competition.

#3 Designing for Business Model Versatility

Thirdly, aside from preparing for the worst, PSFs must seize the opportunity to explore next generation business models to exploit new economic dynamics. Considering the traditional PSF business model, projects are first and foremost driven by the time and material committed to the project. Over the past decades, emancipated clients have increasingly demanded PSFs to share risks by shifting to fixed fee or gain share contracts, amongst others. However, the economics for consulting firms, law firms or media agencies, to name a few, remained vastly unchanged. Ergo, increases in project volume required the firm to scale up staff commitment in order to deliver. But next generation business models are different! Smart Managed Services, Knowledge-as-a-Service, Software-as-a-Service and other subscription type and digital business models allow PSFs to decouple the prevailing, almost linear relationship of project volume (revenue) and staff deployment (cost) – tapping into greater scalability. Admittedly, front up investments into technology, new functions, roles, skills and career paths must be considered, but decreasing run and deployment costs will find prosperous ground in the new generation of on-demand consuming, technology affine and self-serving clients. The projected economic winter might just provide enough push, forcing clients out of their comfort zone towards thriftier, technology-based solutions.

Concluding, PSF leaders must acknowledge: The bullish years are over. Therefore, firms need to act now by designing their individual “recession game plan”. In order to do so, leaders should evaluate their business’ recession risk along the three dimensions of the Recession Resilience Triangle. Focusing on the right clients, delivering firmly architected solutions utilizing versatile business models can tip the scales between winning or losing on the recession’s court.

Get in touch and share your thoughts – looking forward to hearing your comments!

This article was originally published on LinkedIn.