by Sebastian Hartmann, May 2019

Traditional business models for professional services are about to expire

Professional Service Firms (short “PSFs”, such as law firms, accounting and consulting firms, marketing, creative and communications agencies, engineering firms etc.) need highly profitable growth like nothing else. It is deeply rooted in the widely used partnership model of these firms and the traditional “rules of the game” aka cultures, role models and career paths, incentive mechanisms etc.

However, the signs for a paradigm shift in the playbook for growth have increased – the crack in the traditional time and material (and thus mostly input oriented) business model of PSFs is widening at a rapid pace.

Expertise in many areas now runs the risk of being digitized, automated and commoditized. Clients squeeze profitability because of perfect cost transparency (based on the ‘time & material’ focus that even underpins ‘fixed fee’ and ‘gain share’ models in many cases). Furthermore, clients have better access to knowledge, stronger in-house expertise (by hiring alumni) and the traditional opaqueness and agility advantage of PSFs is fading. In addition, clients increasingly question or at least more consciously judge the value of professional services and demand tangible results and impact delivered reliably. Consequently, they are less inclined to accept pricing based on the required delivery time (e.g. ‘billable hours’ as unit measure for the typical input-based business model). PSFs are therefore forced to look towards new business models for renewed growth and better scalability and have begun to compete on risk appetite and delivery efficiency.

The next generation of business models for PSFs is emerging

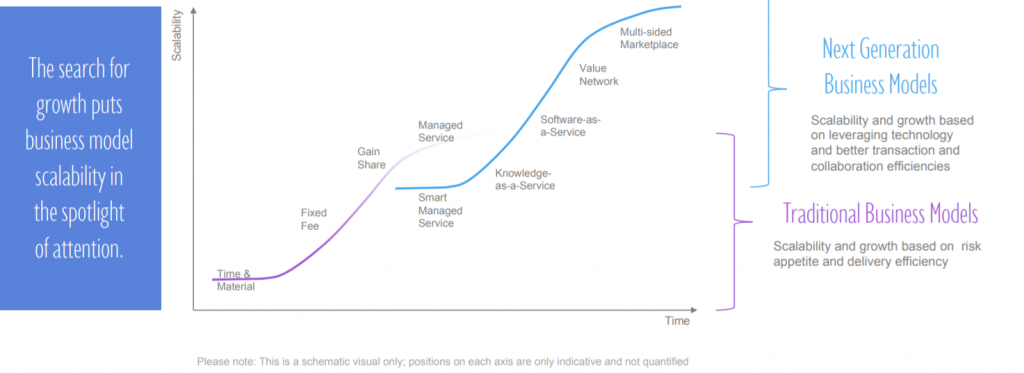

Both established and new players venture into new ways of delivering tangible value to clients and finding smarter ways to charge clients for their work – or rather: the value delivered. We can therefore see two generation curves of business models for Professional Services emerging: The traditional business models, like ‘time & material’, ‘fixed fee’, ‘gain sharing’ or ‘classic managed services’ constitute a scalability curve that is driven by increased risk sharing and delivery efficiency.

The next generation of business models, like ‘“smart” managed services’, ‘knowledge- or software-as-a-service’, ‘value networks’ and ‘two-sided marketplaces’, is largely driven by leveraging technology for scalability as well as lowering transaction costs for clients and providers alike.

The battle of business models for professional services is clearly on: Established and new contestants enter the playground and try to establish their territory across the spectrum of options. The upward movement on the traditional curve is still accelerating and can be observed at many of the traditional big players in consulting, audit / accounting and law firms. In parallel, the same players venture into the next generation curve – where they quickly encounter new niche competitors, but also familiar faces, who explore new growth opportunities.

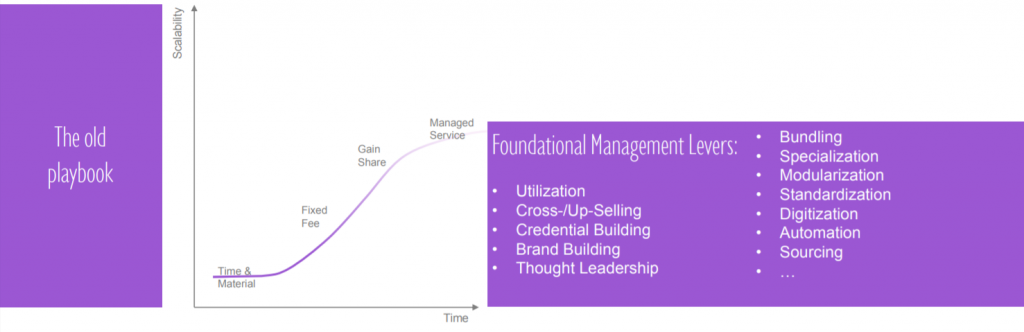

So today, PSF leaders and managers face a wide range of strategic options – where business models not only entail different required capabilities and structural setups but may even be combined. This allows both for balancing performance and risk and may unlock further opportunities for growth. The scope of applicable and required management levers, which used to revolve mostly around managing client relationships and human resources, is much broader now.

How to scale on the traditional business model evolution curve?

Moving along the traditional curve in search for profitable growth would typically involve a parallel and/or sequential exploration of the following management le

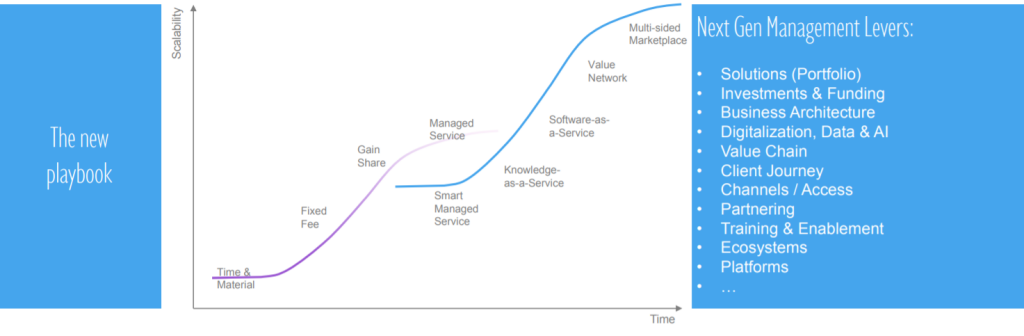

How to scale on the next gen business model evolution curve?

The next wave of business models opens a completely new and widely extended set of management levers. These levers enable PSFs to leverage digital technologies, new value chains and harness the power of network / platform effects to maintain desired growth rates or even move to the next level of scalability. Many of these levers are well known disciplines and functions in other industries but have seen less explicit application or have only been treated as a side hobby of some partners in PSFs. Over the past couple of years, the larger PSFs especially have clearly and visibly invested in building up capabilities around these levers.

As both business models and new management levers can and should be combined for higher growth and a better performance-risk-balance, unfortunately they exponentially increase the overall leadership and management challenge. This may pose particular challenges to smaller PSFs as the industry dynamics continue to increase.

It is time to re-think how to manage a professional service business

As professional service firms embark on this journey with new business models, they encounter the need to adjust or completely rethink their value chains, talent and capability demands, career paths and roles, technology requirements and operations as well as KPIs, cost structures, investment and financing needs etc. The clearly increasing complexity requires a new management approach in PSFs. Traditional organizational structures – even the partnership model itself – can be considered a key source of success of the past. Now, these structures often represent immense hurdles and may soon turn into the biggest challenge for many professional service firms as they try to adapt to a changed competitive landscape and the new rules of the game. This point is also well illustrated for law firms, a particularly traditional segment of professional service firms, by Dr. Michael Smets, Associate Professor of Management and Organization Studies at the Saïd Business School of Oxford University.

Leaders, managers and young talents will need to holistically rethink their firms and how to manage them. A new management playbook for professional service firms is on the table.

Follow me on LinkedIn or Twitter for regular updates and information about Professional Service Firm management and leadership: #NextGenPSF

Looking forward to hear your thoughts!