Article by Sebastian Hartmann, May 2019

Cross- and up-selling are important growth levers

Many high growth markets for professional services require the combination of several capabilities these days (e.g. the many projects labeled as digital transformation). There is also clear empirical evidence that client satisfaction increases with the number of different services delivered by a single provider. Hence, it is no surprise that diversification and inorganic growth have become important play moves for PSFs (Professional Service Firms).

However, while clients increasingly search for more tangible, reliably delivered solutions, they are stilland often presented with explicit CVs and the expected number of hours or days estimated per human resource.This is where things get tricky in sales: Selling diverse services or solutions at different price points (based on different capabilities and different value chains) is likely to cause resistance with clients. This happens especially where PSFs still operate on input-oriented models (e.g. hourly or daily rates): Deploying two different kinds of workforce, at different salaries (and therefore rates) is very hard to argue – and often simply not true.

The paradigm shift in professional services opens changes the growth game

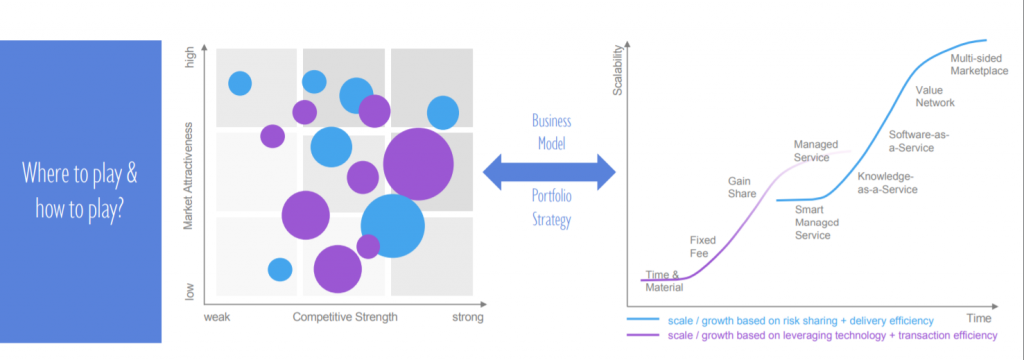

Precisely at this point, the art of cross-selling meets the evolution of business models in professional services: A paradigm shift away from pure competency-oriented services (with input-based compensation models) towards value-focused solutions (with throughput or output-based compensation) has been driving a steady evolution of business models, which I have described in an earlier article. One can observe several larger PSFs, which are now running multiple business models in parallel (often with significant management challenges, admittedly though) driven by specific market characteristics and competitive positions. They have moved past the experimental stage and are embracing this as the new normal.

Mixing business models and matching them with specific client situations and needs has opened a new competitive playground. Let me illustrate this with an example from the wide and classic field of operations consulting:

Procurement consultants are often brought in by clients to analyze spend data and identify some savings potential. Ten years ago, clients would have paid for this expertise. Today this analysis is a commodity service provided for free during the pitch for an implementation project. Or it is sold at a comparatively low price point and with significant technology leverage – from extraction, transformation and loading of data, to analytics, benchmarking, interactive dashboarding and all the way to actionable advice. Smart professional service firms have therefore ventured into providing spend transparency in “software-as-a-service” or “smart managed service” business models. Now, as their installed managed service or software provides the desired spend transparency and savings advice to the client, the more value adding and output-oriented implementation team of the PSF is literally just a click away. Furthermore, the improved ongoing data transparency allows for diagnostics in adjacent fields and cross-selling opportunities, like purchase-to-pay process optimizations, contract lifecycle management solutions, specific legal service outsourcing etc.

Orchestrating business models takes client value and sales to a new level

This not only provides the PSF with an ongoing client relationship (instead of a limited duration one-off project), but significantly lowers their cost of sales for cross- and up-selling and maximizes its ability to detect client needs as they emerge. Clients clearly value this type of approach as it provides a clear solution to the initial problem (e.g. spend transparency), freedom to choose how to execute the derived actions (e.g. spend optimization program or other solutions to adjacent issues) and ease to procure implementation support from a service provider (as needed). The PSF does not even have to explain to the client that their more expensive implementation advice and execution capability comes in at a significantly higher price point than their spend transparency solution – it is obvious and thus clearly acceptable. Needless to say, this implementation project can also be played in a number of ways (e.g. time and material, fixed fee or in a gain-sharing model, which nicely aligns incentives on both sides, or even as smart managed services or knowledge-as-a-service models for filling specific competence gaps).

Cross- and up-selling has almost been an art in professional services. But now we see the traditional art coupled with the solution engineering rigor of a strategically managed, diversified next generation professional service firm. A firm like that manages its portfolio of solutions with various business models and orchestrates the underlying capabilities in a much smarter way. It focuses even more on itsclients‘ issues and unlocks new value for its clients and itself as a provider.

So, cross- and up-selling has become less of an art but more of a systematic method and data-driven approach that facilitates new growth and scalability for professional services. The challenge lies in the much more complex management approach and organizational changes required to pull this off effectively and profitably. It will interesting to observe more and more PSFs exploring business model portfolio opportunities across the full breadth of imaginable professional services (e.g. legal services, creative and marketing agencies and, of course, the many consulting services out there).

Follow me on LinkedIn or Twitter for regular updates and information about Professional Service Firm management and leadership: #NextGenPSF

Looking forward to hear your thoughts!