An article by Sebastian Hartmann, November 2019

Executive Summary:

- The digital transformation and evolving value chain of professional services significantly change providers’ demands for external capabilities, technologies, and services (as sub-contractors, vendors or even alliance partners).

- External spend will continue to grow (e.g. technology, services) both absolutely and relative to revenue. This “spend” is or will soon be critical to client delivery work (aka “direct spend”). Suppliers, vendors, sub-contractors or alliance partners are thus becoming strategically relevant as key pillars to the ecosystem of a professional service firm (PSF).

- The Procurement function (together with other Ecosystem Management roles) will rise to have a seat at the leadership table and a key orchestrator function for operational client delivery work. Only a Procurement function that shapes itself for this role and adapts to the changing business landscape of professional services will live up to these expectations.

Why is the Procurement function becoming more important?

Several trends and developments across professional services (e.g. legal, consulting, marketing, tax, engineering, technology or other B2B knowledge-based services) could be summarized as follows:

- Client demands are shifting towards more result-oriented solutions.

- There is a higher willingness to change professional service providers and a much stronger awareness of specialized and alternative providers to the traditional big names in legal, consulting, accounting or marketing services.

- Professional services are quickly evolving towards more digital or „X-as-a-service” business models, and the market matures through new and more competitive traditional players or even disruptive substitutes (automation and software solutions, etc.). This changes the „architecture“ of value propositions in many cases.

- Changing and extended value chains and much more dependency on third party technologies or collaboration with third parties (e.g. specialists) increases the importance of a firm’s ecosystem and its dependence on external resources.

- Changing workforce demands further contribute to the digital transformation of professional services and the evolution of organizations and ecosystems. Big brands and long working hours are not a measure of success any more.

- Within PSFs we can see a growing demand for a more “connected firm” where technologies, like robotic process automation (RPA), optimized processes and smart service and data providers reduce administrative workloads and costs – and even enable smarter management decisions and steering for every leader or manager. Every day. At every client.

But how does all of this relate to Procurement? After all, the Procurement function in most PSFs used to be limited in scope (aka spend under control) and lingered in the shadows of the necessary but unimportant back-office administration (= non-value-adding) from the perspective of many partners (the highest ranks in traditional PSFs). But with the aforementioned developments well underway and very much in the spotlight for clients and PSFs alike, we see three key reasons for a significant evolution of this function. So, bear with us here:

#1 The shift from indirect to direct spend reflects a growing business impact:

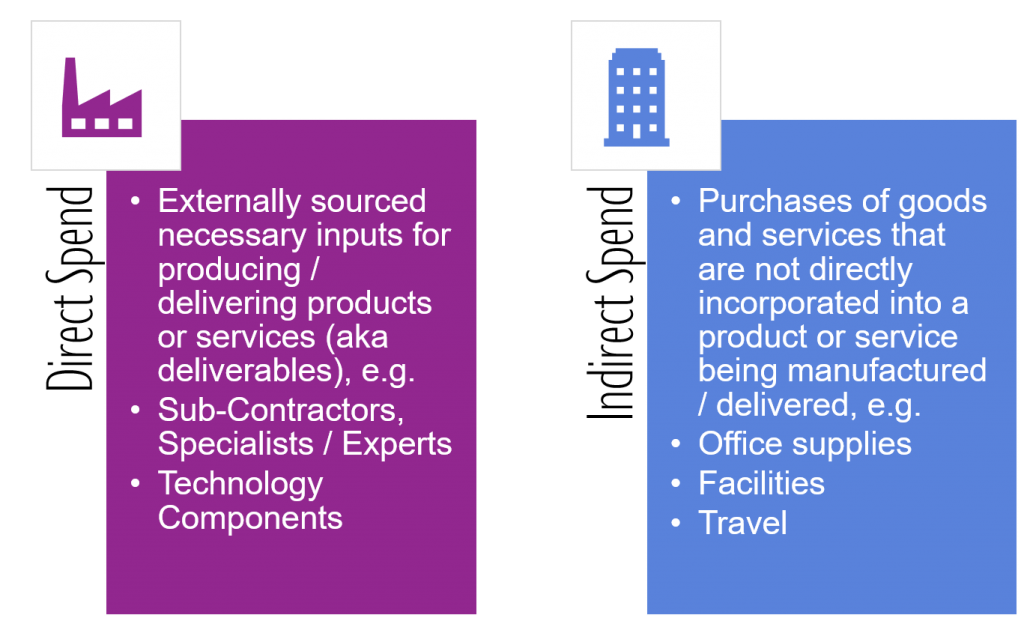

Delivering more tangible client-facing solutions extends and changes the value chain of professional services both up- and downstream (e.g. adding innovation, design and development activities or even recurring after-sales and support services). There is a quickly growing demand for technologies (e.g. cloud infrastructure, RPA (robotics process automation), AI (artificial intelligence) or ML (machine learning) components and new capabilities, which increasingly need to be sourced from external providers. This spend is now actually becoming essential to the client delivery work and thus starts to classify as so-called „direct spend“ – in contrast to most spend being traditionally much more “indirect” in nature for a typical PSF.

By classifying certain purchases as “direct spend” however, PSFs come to acknowledge the fact that the underlying demands are essential to the business, the client-facing delivery work and thus ultimately the operational success of the firm itself. This in turn drives the organisation to develop a much more sophisticated Procurement function. Looking at other industries (e.g. manufacturing, automotive etc.), which have long been aware of the importance of their external value creation (often around 70% of the total value), clearly confirms this – and allows for the adoption of best practices.

#2 Growing spend levels and impact drive expectations of Procurement‘s new role:

Higher spend levels translate into a higher bottom- and even top-line impact. Procurement is thus moving more and more into the spotlight of attention – even in terms of plain financials. Furthermore, the growing externally sourced demand and thus share of the total value chain (e.g. technology used for client-facing solutions) needs to be more professionally managed in order not to lose scalability, performance or savings potential (or all three). This operationally critical role cannot be left to traditional professionals (who are busy delivering work to clients) and must not be regarded as a „client by client“ or „one-off project exercise“ – unless the firm wants to leave a lot of money on the table and risk its mid or long term profitability.

So, truly supporting the business of a PSF exposes Procurement to the rising demand complexity (due to quickly evolving client-facing solutions, products, and services) and the challenge of operational tail management. Especially this last challenge is closely coupled to the IT function‘s typical quest to become truly bi-modal – and thus capable of supporting new and changing business needs while maintaining performance levels of existing and more traditional support demands (e.g. desktop IT). So, with the growing importance of sourcing activities to the business success in a PSF, the role and expectations of Procurement rise in parallel.

#3 Ecosystem and supply questions shape the strategic PSF agenda:

As we can see, digital transformation, innovation, scalability and growth enablement are high up on the strategic agenda for professional services – and in most cases require significant external resources, partnerships, and capabilities and thus entail changes to a firm‘s ecosystem, which must be powered to a large extent by the Procurement function. Clients may even explicitly require PSFs to deliver jointly with „partners“ or specific vendors, which need to be managed, orchestrated and thus become an essential cornerstone of an ecosystem strategy (a key element of any strategy today). Michael G. Jacobides summarizes this nicely in his recent HBR article: “Business is undergoing a paradigm shift as a result of digital innovation: The very nature of competition is changing. Competing is increasingly about identifying new ways to collaborate and connect rather than simply offering alternative value propositions.” The Procurement function is naturally a key player for establishing and maintaining many of those connections for a PSF.

Procurement‘s New Playing Fields and Value Levers:

So, in essence, these three changes will pull the Procurement function out of the shadows in many firms – at least in those firms, which adapt to the changing competitive landscape and client demand evolution. Being able to fulfill the new expectations will often require investments in the Procurement function, which today is not equipped to handle this new “direct spend” for a PSF’s business needs (because it never had to). It is vital to understand that this is not an investment into a “non-value adding back-office function”, but an investment into the future competitiveness of the firm – no matter whether it is a legal, consulting, accounting, marketing or some other B2B service provider; this theme is clearly echoed across professional services these days.

The critical playing field, which the Procurement function needs to master, is likely to revolve around the following demand categories:

In of my upcoming article, I will discuss these categories in more detail. Together, we will also look at the key activities and new value levers, such as

- Business Connectivity: Category Management & Category Portfolio Management

- Trusted Partnering & Transactions: Supplier Relationship & Ecosystem Management

- Access & Convenience: P2P, Marketplace and Catalogue Management

- Innovation & Intelligence: Innovation Scouting & Competitive Intelligence

Mastering the new playing field and the above-listed value levers (often relatively immature when compared to other industries) requires the Procurement function to grow through new talents, develop and re-shape its existing structures, roles and skill profiles. But the biggest change needs to happen within the mindset of many PSF leadership teams: They will need to acknowledge the fact that the recipes for growth and success have changed – and that their traditional view of a PSF needs to be reshaped. New activities, skills, and talents will determine a firm’s competitive position as of… today.

—————————————————————————————————————

I would like to thank Bobby Dhanoa and Michael Münnich for their Procurement insights and valuable feedback on this piece – and, of course, for our ongoing collaboration.

Please let me know what you think: Looking forward to reading your comments!

This article was orginally published on LinkedIn.