An article by Sebastian Hartmann and Hans Winterhoff, July 2019

More than 89% of the professional service firms surveyed by KPMG, expect significant transformational change over the next 3 years. This is expected to affect not just their solutions and services, but also the operating and business models. Not surprisingly, we have already seen significant efforts being made to set up innovation initiatives, start-up collaborations and digital hubs or units in many consulting, accounting, tax and law firms over the past years. In parallel, we can witness the first completely new and potentially disruptive competitors emerging – often powered by data and AI-driven business models. So, „change“ has professional services in its tight grip – and it is here to stay.

But how well are the established players handling their own change? Are their transformation efforts living up to the expectations? In many cases, when we talk to senior leaders or key players behind closed doors, the answer is a clear „no“. New, innovative solutions receive barely enough funding to see the first glimpse of daylight. But even when they are successful with a pilot client, they remain far from achieving significant scale and reaching a tipping point for the organization as a whole. Innovation key players frequently part ways with their firms in frustration from a lack of progress and commitment. Employees are increasingly leaving their attractive compensation packages behind and move on to small and risky start-up firms in order to experience some „real change“. In short: The innovation engine of many firms seems to lack power… and the future readiness of many firms appears questionable. Why is that? After all, there is no lack of talent, analytical and strategic capabilities or money in this highly profitable industry.

Our research seems to point towards three large hypotheses, which seem to constitute the major challenge. We are tempted to call them the three „silent killers of innovation and future readiness” in professional services these days:

The drug of a highly profitable, utilization oriented business

Many consultants, auditors, or lawyers still define themselves by being busy. The busier they are, the more money they are making – or so it used to be. When a substantial amount of the business is based on billable hours, there is very little incentive to increase efficiency or to create the freedom (= non-billable time) to innovate and develop new solutions, as Prof. Richard Susskind points out in his book „Tomorrow‘s Lawyers“ (p. 17). The transition from the traditional approach of selling hours or days is hard – and many firms fail to truly monetize their innovation, design and development efforts, their increasing use of technology and thus ultimately their IP. This neglect of the potentially more scalable new assets in combination with dramatically changing and technology-impacted core activities (all the way from sales, delivery into operations, support etc.), may signal exactly what Anita M. McGahan has described as „intermediating change“ (in her article in HBR): „Executives tend to underestimate the threat to their core activities by assuming that longtime customers are still satisfied and that old supplier relationships are still relevant. In reality, these relationships have probably become fragile. The value of core assets often escalates, which compounds managers’ confusion. (…) During periods of intermediating change, pressure in the industry tends to build until it hits a breaking point, and then relationships break down dramatically only to be temporarily reconstituted until the cycle is repeated.“

The lack of value orientation in partnership firm structures

A major share of professional services is set up and governed through a partnership model, which has proven to be very successful in a world, where „you can only eat what you kill“. The model minimizes many risk factors and is effectively coupled with sales and utilization oriented incentive schemes. All profits are distributed among the partners at the end of the year – leaving the firm stripped of investment powers. Firm value is not in focus for most partnerships and therefore not incentivized. Intellectual property is often not even actively managed and hardly ever found on the balance sheet, despite the increasing use of technology, which makes IP also much more tangible. Unfortunately, this drives short-term thinking and decisions: Investments with horizons longer than 12 months are not very popular decisions – especially with the older more powerful partners, who tend to have shorter investment horizons. Being unpopular is something that the often elected leaders in partnerships cannot afford. This traditional leadership culture is well described by Laura Empson (in a recent HBR article for further reading). It makes the required strong leadership commitment for fundamental change and business model transformations a major challenge. More dramatically, the short-term thinking and lack of value orientation strip PSFs of organic funding options for investments into their future and the patience to make them work and iterate along the way.

Hybris and a lack of management skills

Professional services are characterized traditionally by almost artisan-guild thinking: What is sold to clients is still often ill-defined, vague and fuzzy, as Fiona Czerniawska, Managing Director at Source Global Research has frequently pointed out. But clients are demanding tangible solutions and a clear measurable value add these days. Outcomes cannot be left to chance or individual experience but need reliable and systematically managed delivery in time and in quality – and most importantly at a clear price point, which is clearly not based on the required input anymore.

But the generally rather collective and loose management of value chains and core activities has bred what could be diagnosed as a „serious lack of management skills“ in any other industry or company. In the past, this has only been an issue whenever professionals have gone into management roles in other industries, where this skill gap often became quickly visible. But now it may turn out to be detrimental to PSFs: Many of the emerging business models for professional services require different value chains, operating models, ecosystems and thus new and much more actively used management levers, which have traditionally not been part of their (rather slim) management playbook. PSFs must hire and develop new talents capable of filling these often new management roles. And they will ask questions about their career paths, too, which need to be designed and integrated (read our article about these alternative career paths here). Moreover, cultural changes would have to be managed, avoiding the typical traps of e.g. just focusing on additional attributes on corporate websites (e.g. as illustrated by Gartner’s research). But driving new and systematic approaches to manage professional services does often not sit well with the strong egos of established rainmakers. It threatens their carefully curated recipes for success. Putting on a rigorously client-centric strategic lens and establishing new roles across the business and down to the specific value chain and operations is quickly dismissed as „administration“ or „back office“ and generally not value adding behavior. This hybris may turn out to be costly – at best.

The three silent killers are not a surprise to many seasoned professionals. Unfortunately, these killers also tend to team up and then manifest as a very strong lock-in with yesterday‘s fading business. Therefore they threaten the future of many professional service firms – and the fantastic talent and capability, they have honed and curated over the years. But a few firms demonstrate that there are ways to escape from these killers and prepare, evolve and succeed in the next generation gameplay of the professions:

Innovation efforts need to be unchained from the traditional utilization-oriented model by consciously focusing on new business models. Studying how the traditional business model is already being unbundled by new market entrants, can be a good starting point. Actively venturing into new models may require to consciously replace and cannibalize existing business, but it will help to achieve significant scale faster and thus foster urgently needed scalability (also a key capability to be developed). Reconsidering the concept of “ambidexterity” may be helpful to think this through from an organizational point of view. Of course, this will require some space and patience.

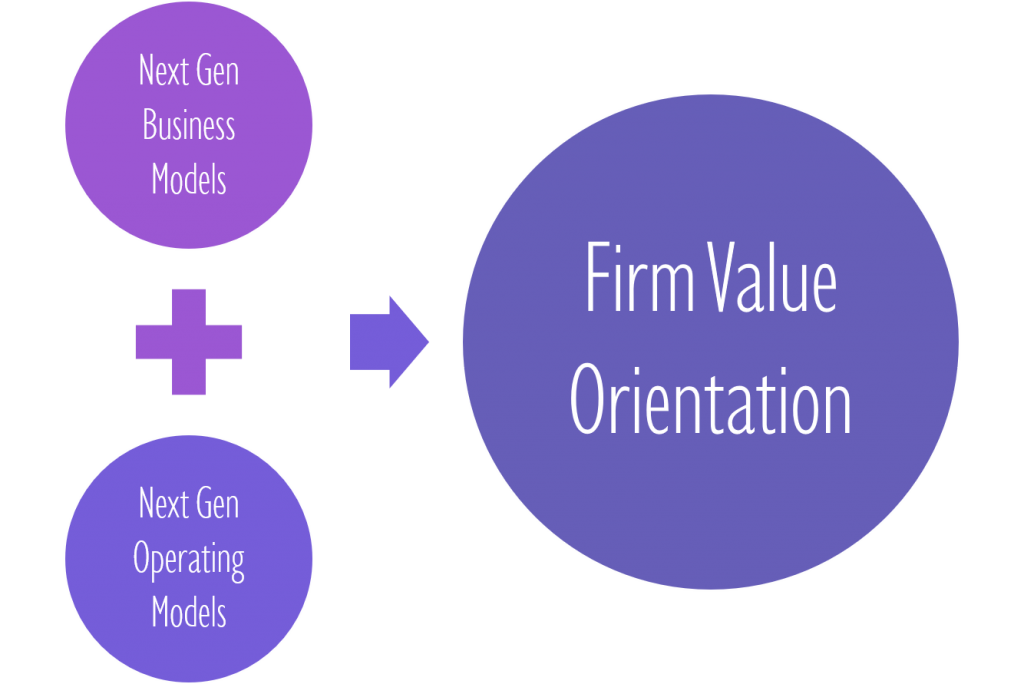

PSF leaders need to accept and consciously design new cost structures and rising innovation, development, and technology spend. It is a new factor, which needs to be used for the creation of long-term sustainable value. Therefore firm value needs to be embraced and anchored in the steering mechanisms of the firm. New valuation models for IP, currently already considered in evolving discussions on accounting and valuation, will provide a setup for an adjusted, mid- to long-term perspective on incentive regimes. It will allow for the expansion of investment horizons and unlock new alternative funding mechanisms by bridging age gaps within the partnership or by using internal crowdsourcing or external capital sources.

Ultimately, the leaders, managers of today and tomorrow need to accept that management approaches are changing. The next generation organization will look very different. PSFs need to consciously experiment with new operating models and thus management approaches. So in a way, they can practice what they preach and study other industries, start-ups, or learn from fresh and outside talent to uncover their own next generation management playbook. Only then will the established players be able to breed their future growth engine and compete with the emerging, new players.

Follow me on LinkedIn or Twitter for regular updates and information about Professional Service Firm management and leadership: #NextGenPSF

Looking forward to hear your thoughts!