An article by Sebastian Hartmann, Stephan Kaufmann and Hans Winterhoff

Anyone who is trying to motivate the partners in a law, consulting, accounting, engineering or any other typically partnership-based firm to start or keep investing in innovation, will quickly understand what we want to talk about in this article: The importance of measuring innovation and providing evidence of how partners‘ money is being spent. And that it is money well spent.

Despite all debates about the (obvious) difficulty of measuring innovation, let alone innovation management, we believe and have seen that three elements can make a lasting difference:

1. Regular Innovation Reporting & Communication

2. Lifecycle & Portfolio Awareness

3. Solution Performance Management

Understanding these three elements can make the difference between a continuously innovating, successful firm, ready to play in the future league of professional services, and one that will be condemned to linger in the shrinking niche of an overcrowded, blood red, traditional services market.

Regular Innovation Reporting & Communication

In order to demonstrate the effects of innovation efforts, it is vital to have a clear understanding of where resources like people (and their time), technology and thus ultimately “the money” goes. At KPMG, we (Hans Winterhoff as “Head of Innovation” and Sebastian Hartmann as “Head of Solution Portfolio Steering“ at the time) used to meet regularly to ensure an aligned understanding of this and being able to answer at least these typical questions (amongst others) to KPMG’s leadership and partners:

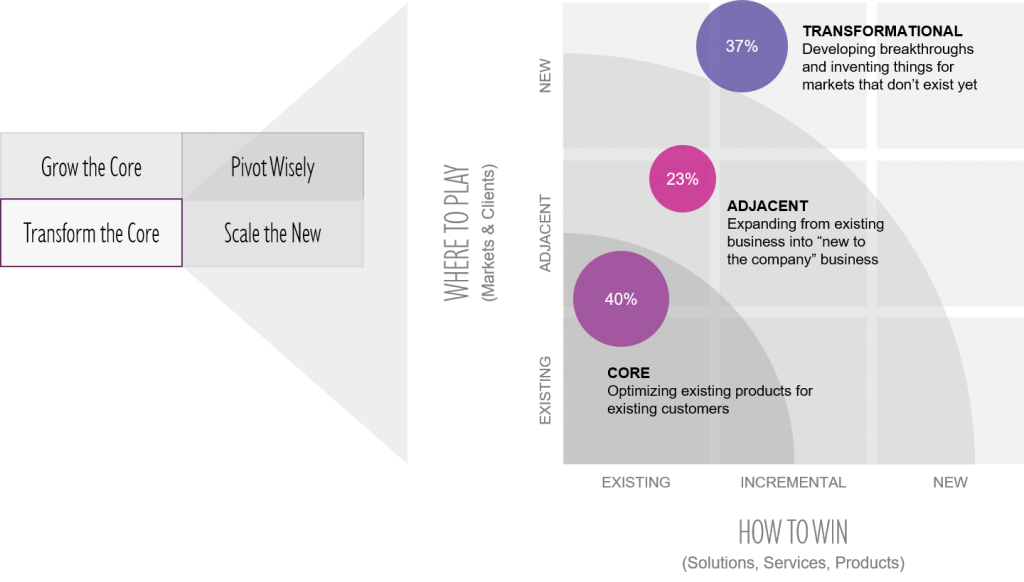

- Which solution (product, service) has been (or should be) innovated this year*? Does it classify as an incremental, adjacent or transformative innovation?

- How much innovation effort (“money”) went into this solution?

- How has the overall portfolio been affected? How do newer solutions compare to older ones?

- What is the total share of our revenue coming from innovative solutions?

- …

* (side note: At KPMG, we measure and report market success of innovated solutions over a three year period (year 0 = innovated in this year + year 1 and year 2), see below).

The resulting “Innovation Evidence Report” has been and still is a cornerstone for steering innovation management at KPMG. While it does not necessarily reflect how innovation work is being done, it provides not only the reasoning but also the success stories required to keep partnership funding and to drive acceptance. It also builds an understanding for the type of work that is being done – and how it translates into the business of the firm.

However, this message is no good if it sits in your management information systems. This story needs to be told. Over and over again. Every year. Every quarter. Maybe every month – depending on the speed of your firm’s business environment.

Lifecycle & Portfolio Awareness

When looking at the business of a professional services firm – especially from an innovation, transformation and change angle – it is crucial to acknowledge the firm’s overall environment, context and strategic position and each solution’s (service’s and/or product’s) portfolio position.

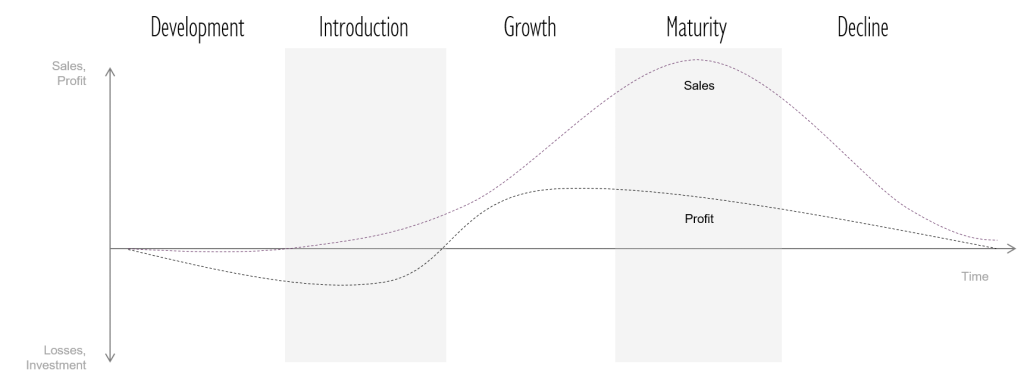

A typical challenge often faced here is the actual definition of the traditionally fuzzy professional services provided to clients (esp. in consulting, legal, marketing etc.). However, as clients increasingly demand much more result oriented and increasingly digital solutions, the need for a much clearer understanding of the actual „fields of play“ and offered solutions (services, products) in comparison to the competition becomes inevitable. The attractiveness of a particular market and a solution’s competitive maturity greatly influences its revenue and profitability profile. The lifecycle concept may help to determine the situation of a solution as the following „classic“ graphic nicely illustrates:

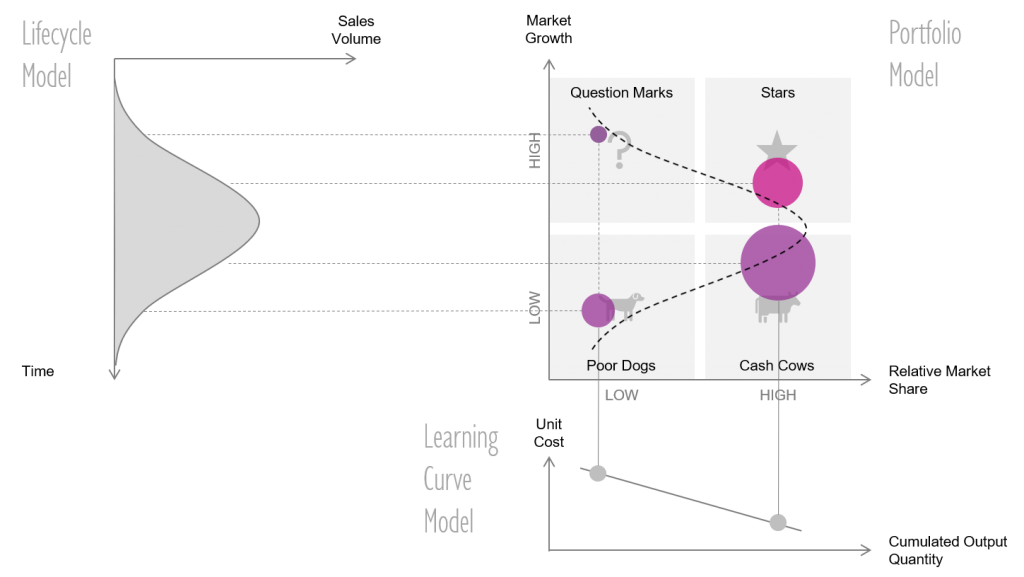

The lifecycle concept is material for the understanding of a solution’s market position – and thus for your firm’s entire solution portfolio (when applied across all your solutions, products, services):

The typically derived classic matrix view serves innovation management as a basic orientation point for strategically directing its efforts where it matters the most. It can help to answer questions such as:

- How does your firm’s portfolio deliver value to clients – and how is this reflected strategically?

- Which solutions should be harvested or defended? Which solutions are likely to grow fast?

- Which solutions may need support in order to improve their market position?

- What is the projected future growth and profitability potential of your firm’s portfolio?

- Where does your firm’s portfolio lack density? Which markets may be attractive?

- Is the innovation pipeline sufficiently filled?

These questions are the heart of any strategic discussion and consequently need to be linked with your innovation management. Especially in a partnership, you need to provide reasoning why partners should forego a share of today’s bonus to finance future revenue delivered through “colorful design thinking spaces“ and by “crazy people, who put post-its on the wall” (instead of the good old and immediately billable client facing work).

We would like to point out that these analyses are only one possible and helpful angle. There are various methods, which need to be carefully employed in order to derive a strategic approach, which is in line with your firm‘s or specific solution’s environment. These environments may also be quite heterogenous across your firm’s portfolio of solutions (products, services) – especially in a diversified large professional services firms, such as KPMG.

Solution Performance Management

Last but not least, the traditional KPI spectrum of lawyers, consultants, accountants etc. must expand beyond utilization, hourly rates, PEP or partners‘ sales contributions: It requires a clear understanding of all actually delivered solutions – and their return on investment across multiple clients, engagements (projects), partners and even fiscal years. Investing in more scalable, often digital (aka technology- or data-driven) solutions requires a management angle, which drives performance way beyond the reach of a single, isolated partner. Most business cases with the classic “hockey stick” growth curves actually tell this story. Nonetheless, it is still not well known in many law, consulting or accounting firms (mostly because the traditional time & material and individual-partner-case thinking is not about scalability at all). Actually measuring the performance of each and every solution is therefore key to managing and scaling solutions in general. It is almost like a new growth mindset – it is also the foundation of managing a solution portfolio as well as the innovation efforts of your entire firm. So, it also about making smarter strategic decisions and spending every precious dollar wisely and effectively.

With the pace of (digital) transformation and innovation increasing across various segments of professional services, the importance of systematically managed innovation increases as well. And facing the current global and local economic uncertainties or even the threat of an economic downturn is not likely to diminish this need for innovation – it may actually even become the catalyst to an even faster pace of change in legal, consulting, accounting, marketing or other knowledge-based services. So, making sure that your firm

- collects clear evidence of its innovation efforts,

- communicates this evidence concisely and with respect to lifecycle, portfolio and market conditions, and

- stays in control of its investments (= management of its client facing solutions) in the long run

will make a difference – and allow you to keep the innovation engine fueled up and running. This is even more important when the going gets tough and the reflex for “cutting costs” (or questioning non-billable work) grows. Quite possibly this is going to be THE difference between firms that systematically innovate and reinvent themselves and some accidental “one hit wonders” (who just happen to stumble upon some innovative solution) or the traditionalists, who are happy to ride their horses solutions until death (= end of the lifecycle aka retirement age of the leading partners).

This article was orginally published on LinkedIn >>